Fixed and Variable Rate Reimbursement (FAVR)

Reimburse employees fairly and accurately with our AI-powered FAVR engine. The Kliks IRS-based Fixed and Variable Rate (FAVR) calculates the cost of owning and operating a vehicle based on where your employees live and work. Our innovative AI-powered algorithms take the complexity out of rate generation and FAVR administration, while helping lower your costs

FAVR with more admin power

and no annual contracts

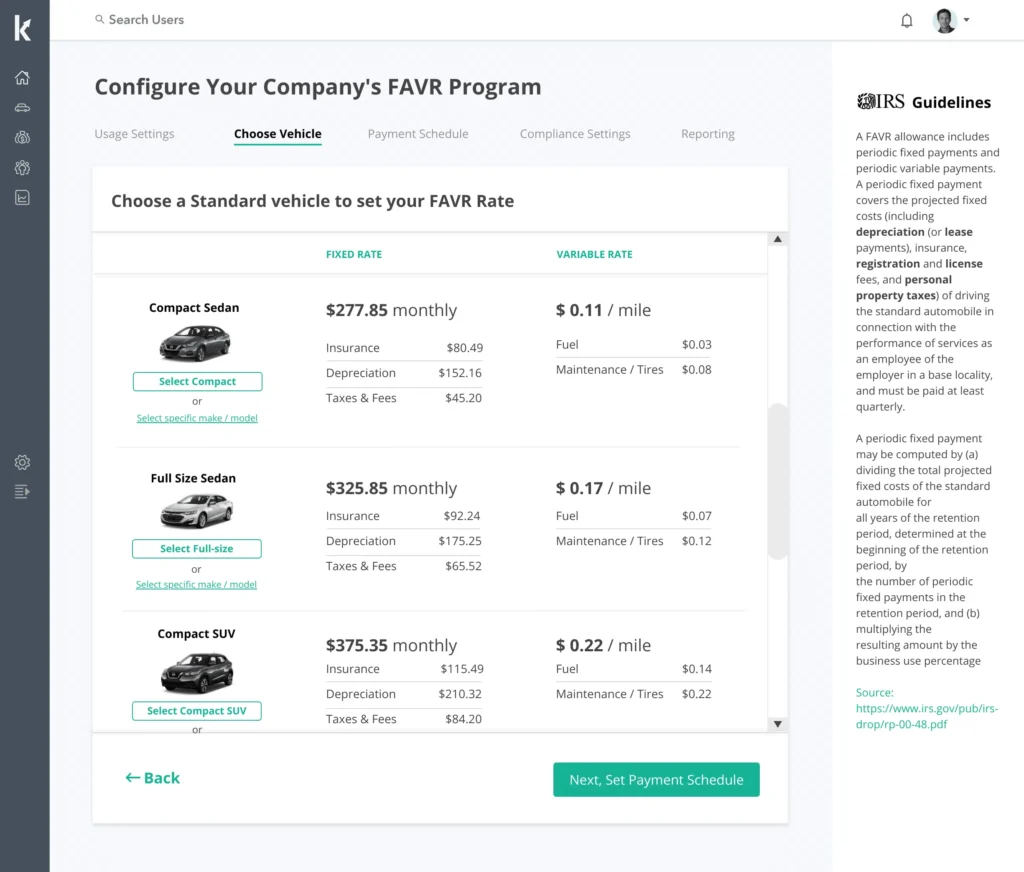

AI-Powered Rate Calculation

Define rates by base vehicle and any location.

Complete Control at the Admin Level

Unlike other solutions, you have complete control over your reimbursement program.

Record Trips on IOS, Android or KliksSnap OBD

A battery-efficient mobile app that just works or use our award-winning OBD solution

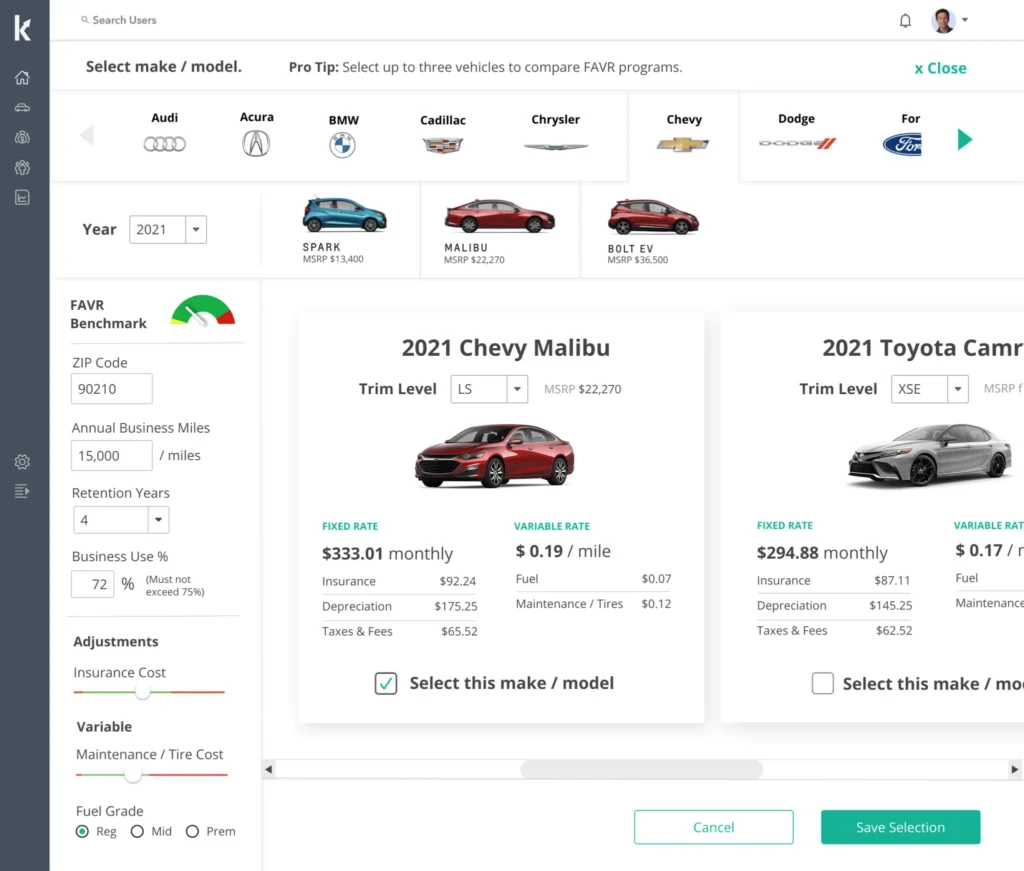

Define Your Reimbursement Rules

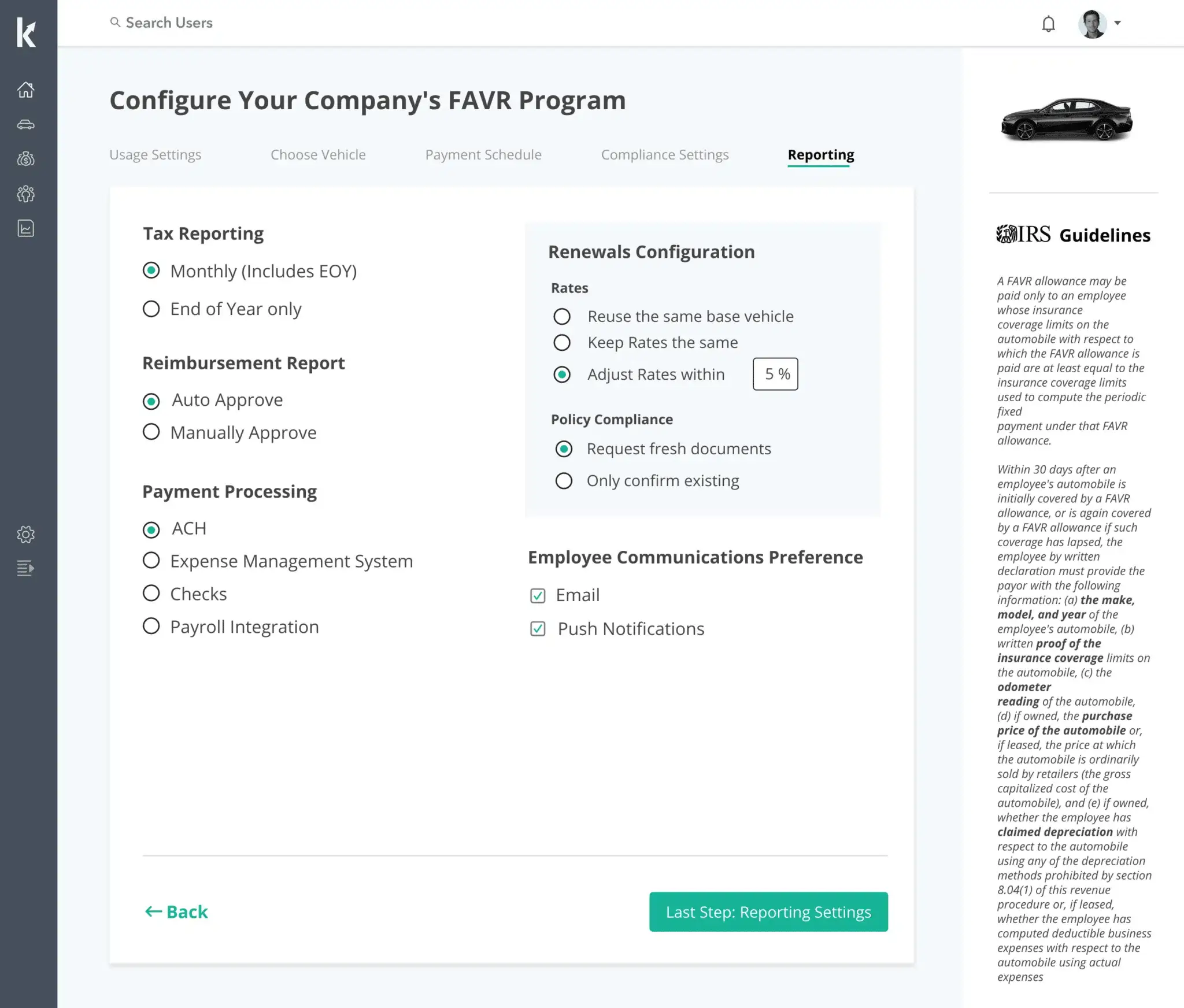

Automate reimbursements with flexible payment schedules and adjustments.

AI-Powered Rate Calculation

Define rates by base vehicle and any location.

Complete Control at the Admin Level

Unlike other solutions, you have complete control over your reimbursement program.

Record Trips on IOS, Android or KliksSnap OBD

A battery-efficient mobile app that just works or use our award-winning OBD solution

Define Your Reimbursement Rules

Automate reimbursements with flexible payment schedules and adjustments.

Driving and maintaining

a personal vehicle for business

Has everything to do with location

- With Kliks FAVR, you can track mileage accurately, right down to the tire tread

- FAVR rate: A fixed and variable rate allowance accounts for the exact set of expenses between employees and vehicles.

- Fixed cost: A fixed cost is a consistent cost, such as a registration fee or an insurance premiums. Both fixed costs and variable costs are specific to employee and location—costs that come with the territory.

- Variable cost: A variable cost concerns the vehicle itself, such fuel and maintenance. Both fixed costs and variable costs are specific to employee and location—costs that come with the territory.

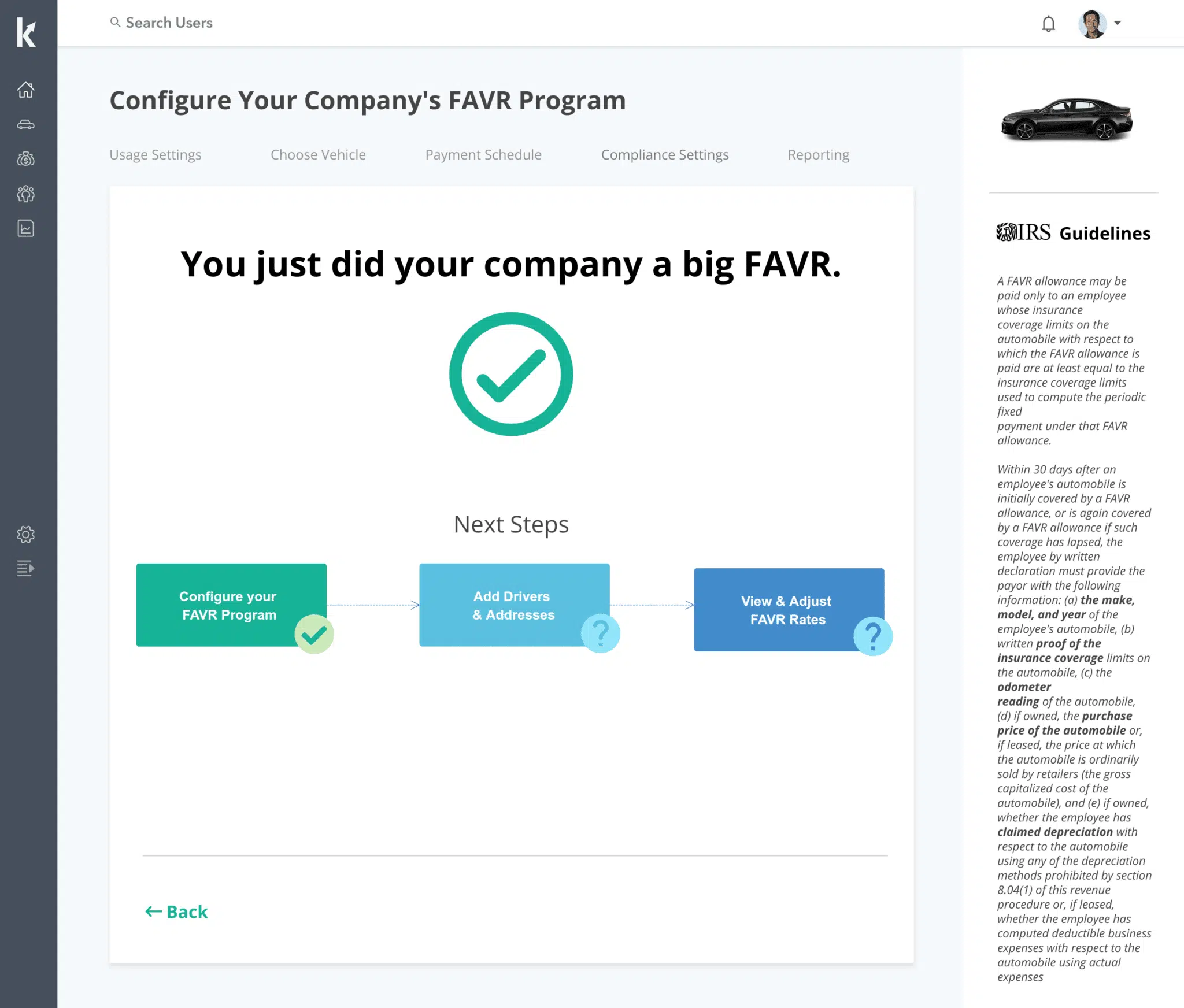

How it works

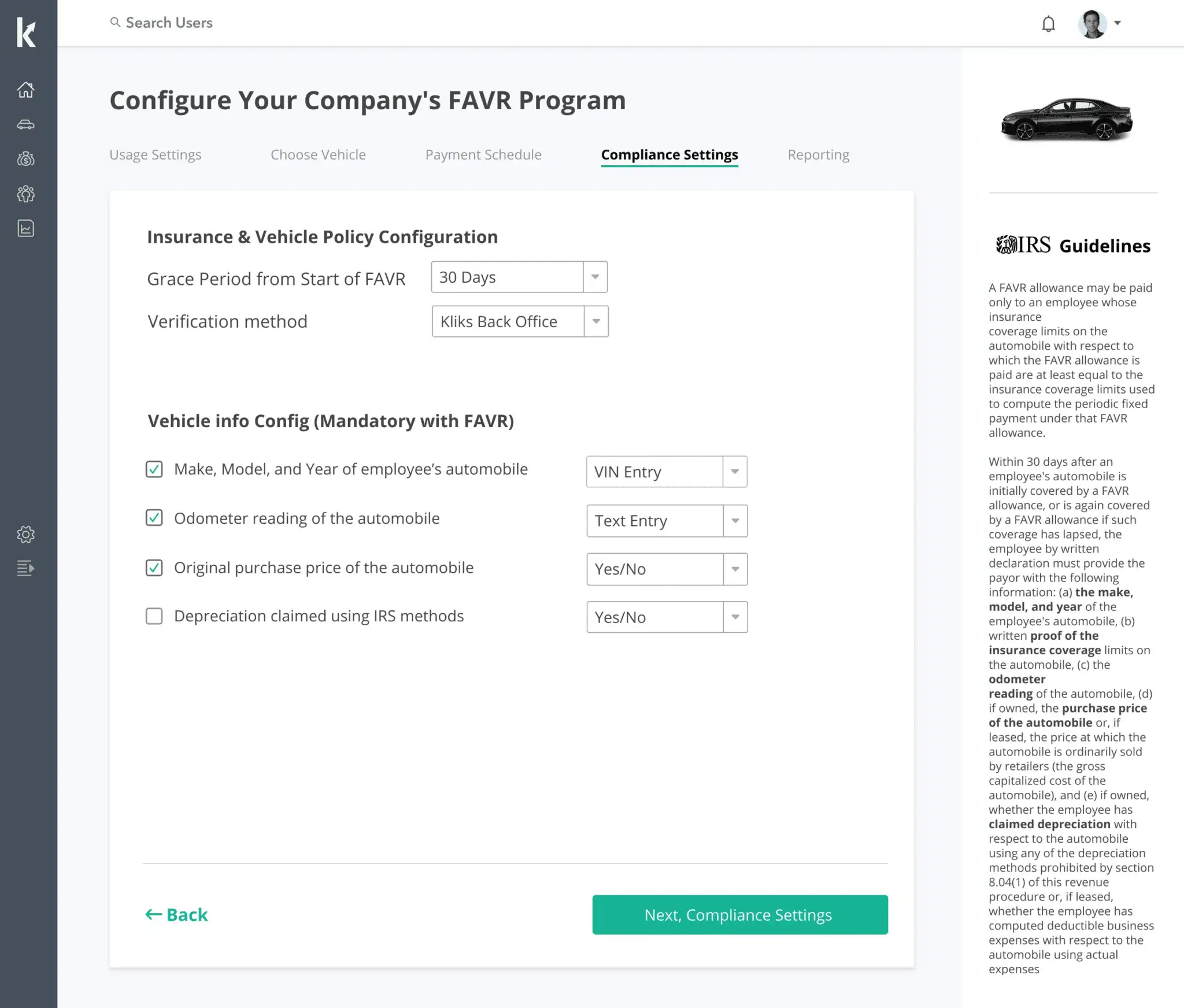

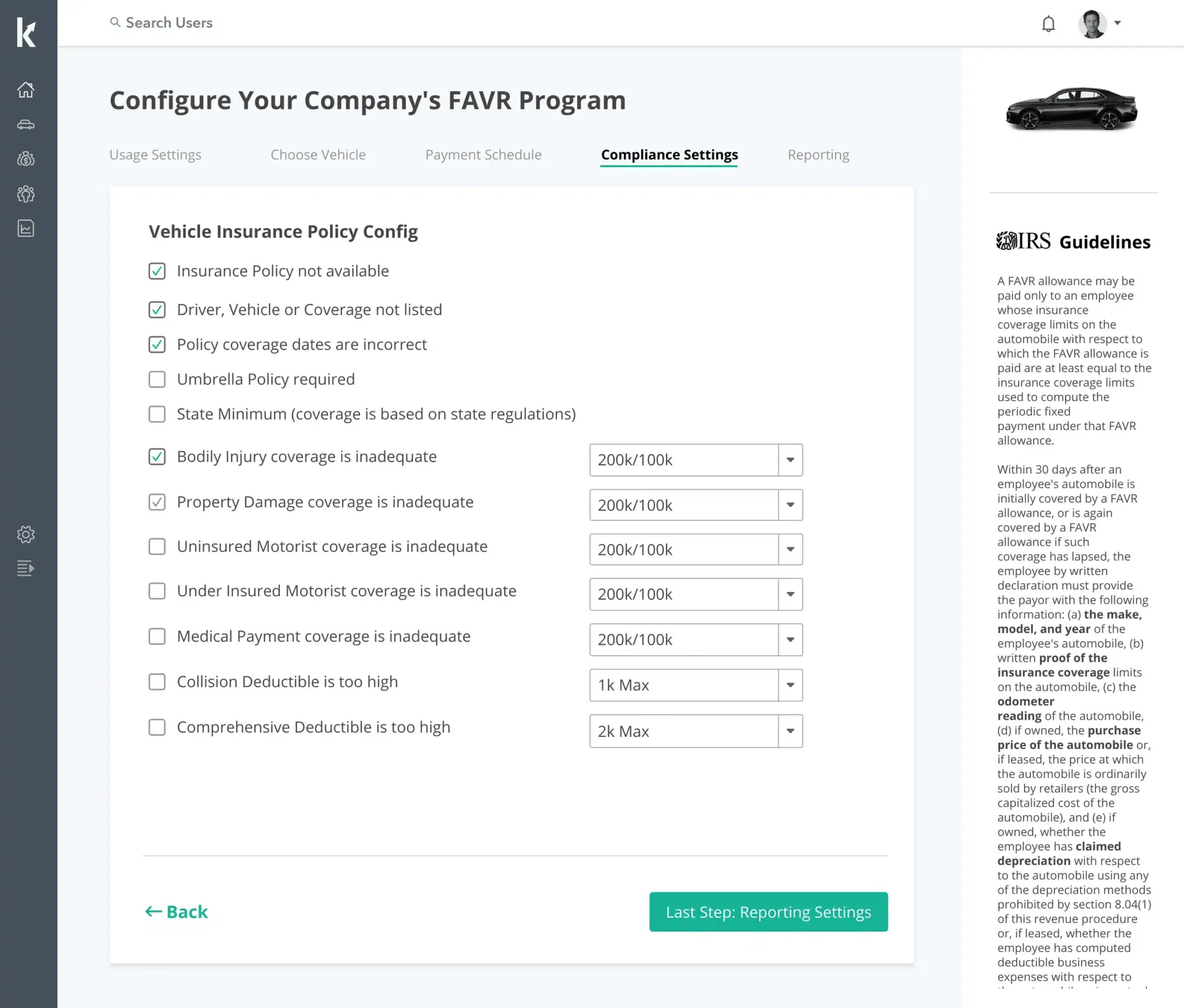

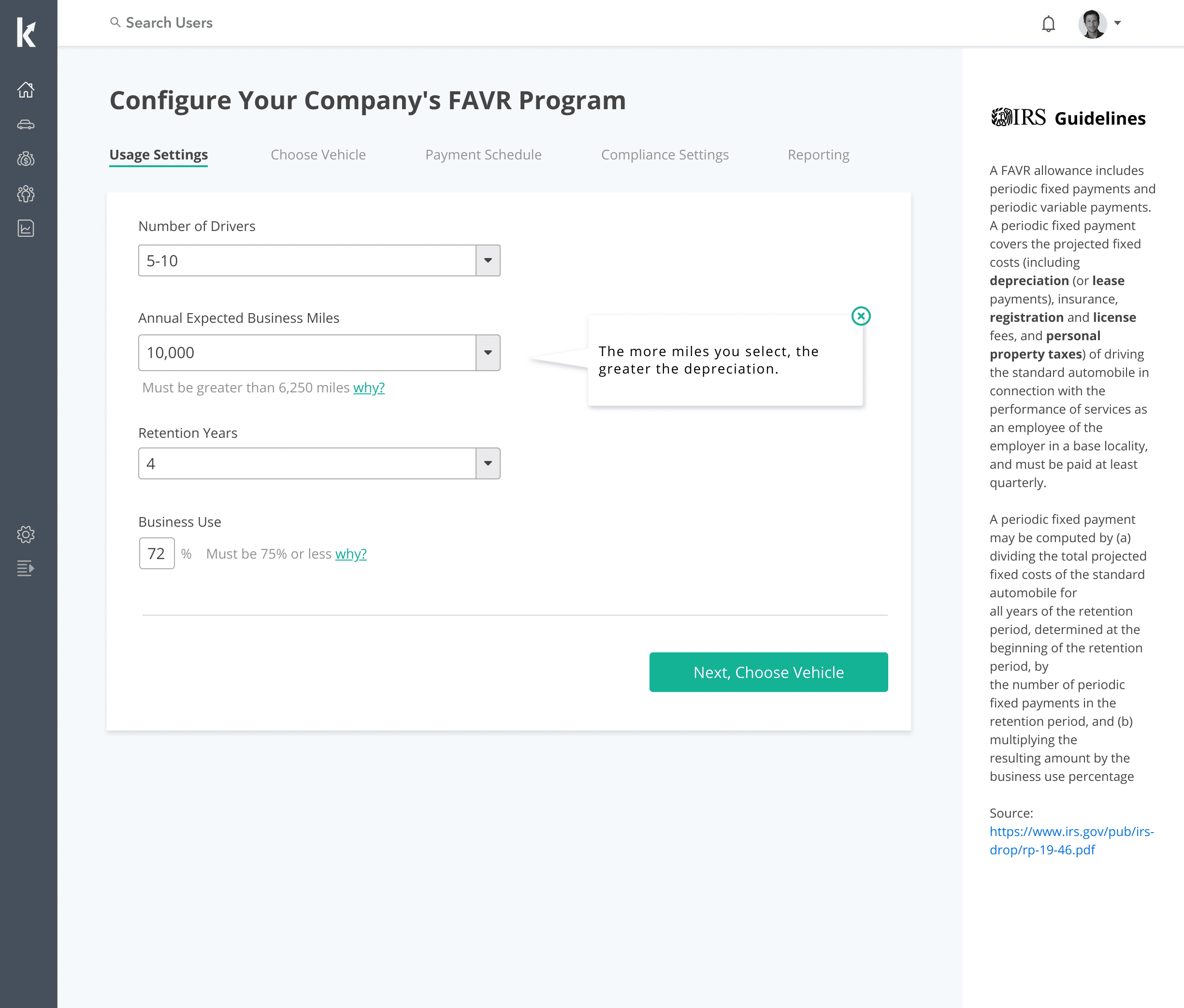

- Set your FAVR parameters based on sample Kliks.io templates or your own parameters

- Use our batch upload / HRIS integration for employee information input (Name, Location)

- Create Groups, Group Managers as necessary

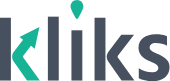

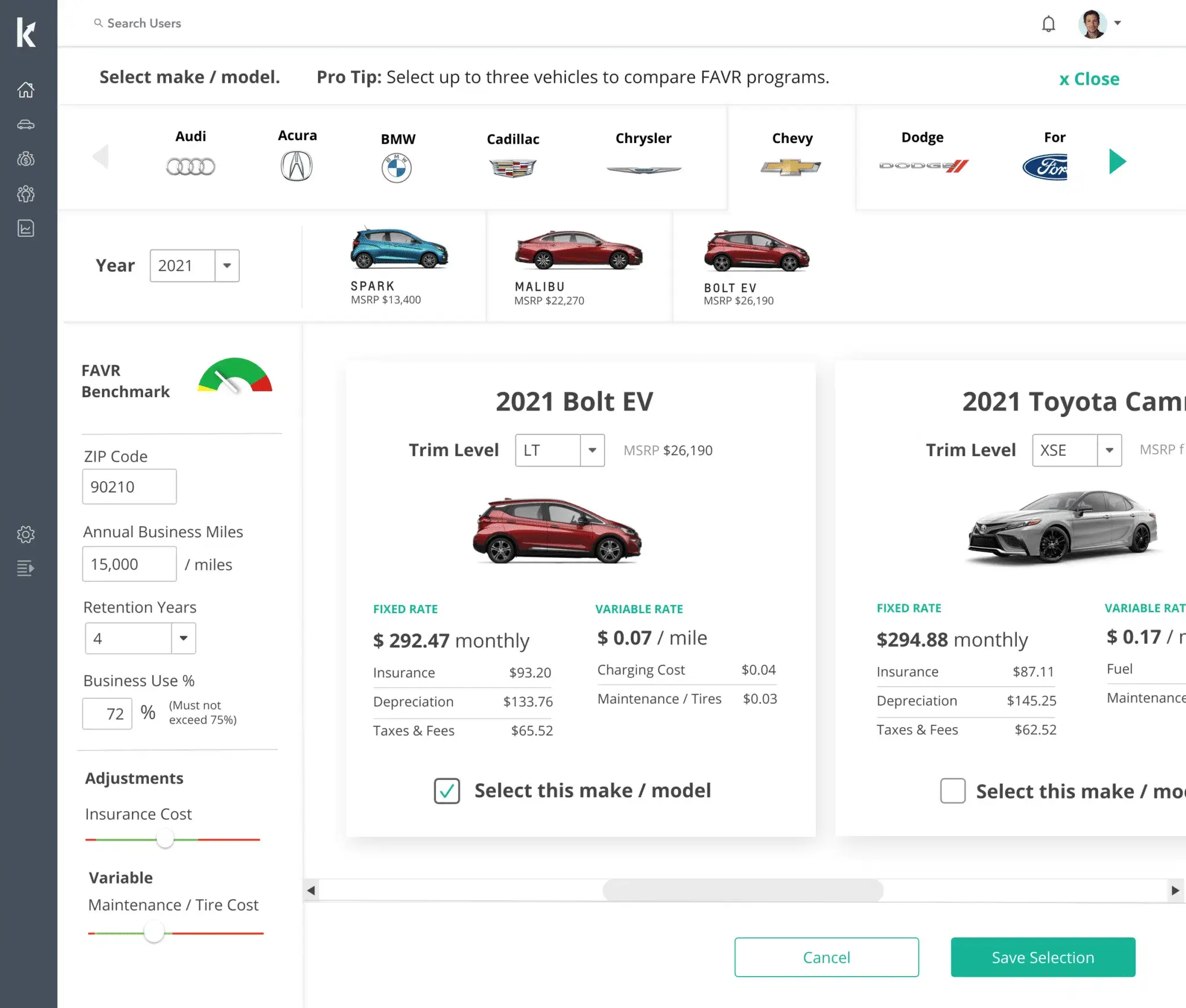

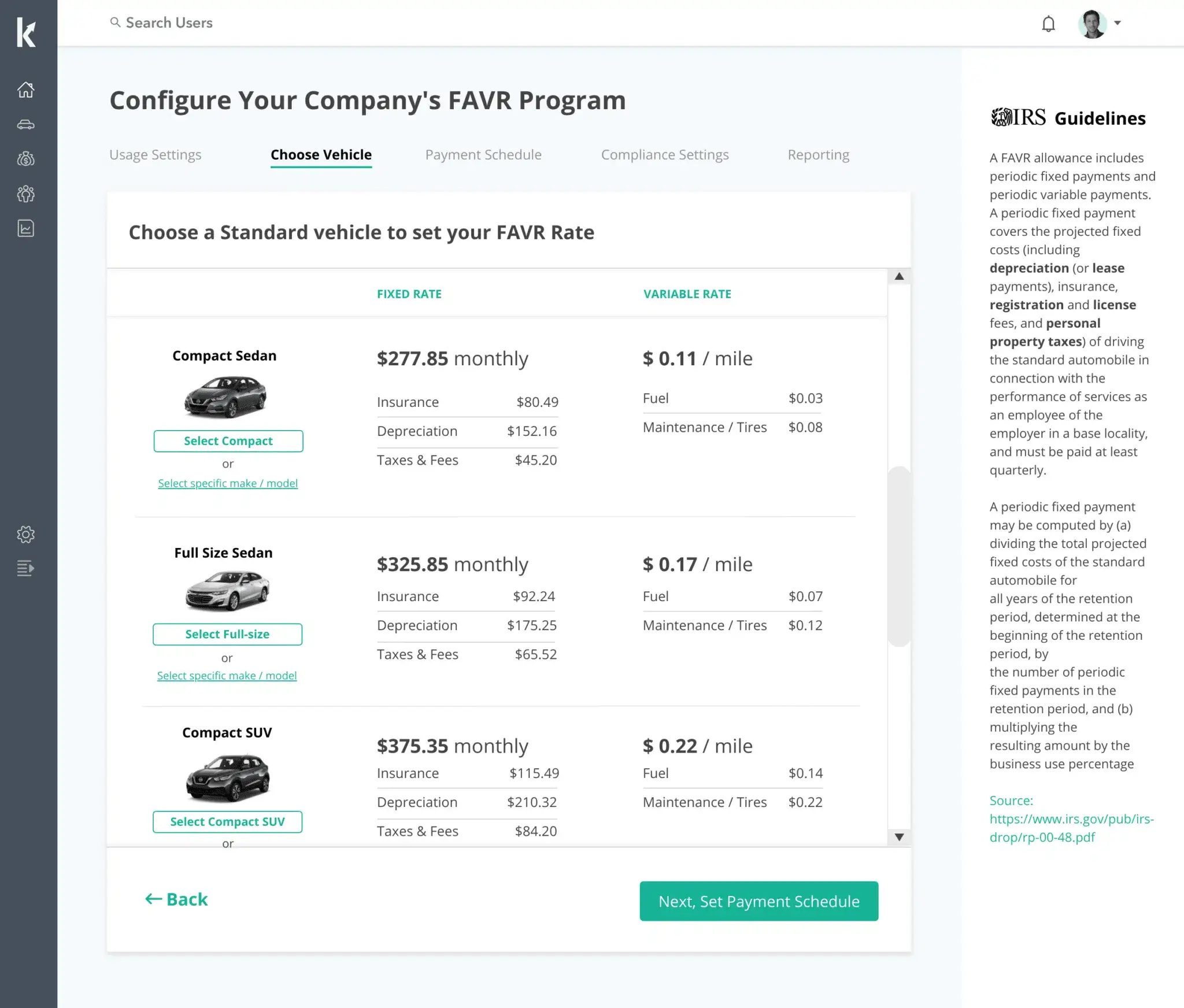

- Select Base Vehicle, Payment schedule (weekly, monthly, custom), and Approval flow

- Review generated FAVR rates, make any adjustments at the driver level and proceed to program start

How it works

HOW DO YOU PAY YOUR EMPLOYEES FAIRLY BASED ON WHERE THEY LIVE AND WORK?

The cost of living and operating a vehicle differs from city to city, gas, maintenance, insurance, etc. FAVR by the IRS takes all this into account so that you can reimburse fairly. This has tax benefits for the employee and savings for you

Solution

Individualized reimbursement for unique circumstances. Folding all the factors into a comprehensive solution. Sound complicated? Kliks FAVR makes it easy by streamlining the data into a user-friendly, IRS-compliant mileage tracking engine.

Accommodate your employees, your budget, your schedule, and the taxman. Simplify where it counts with Kliks FAVR.

Full support for Electric Vehicles (EVs)

Deriving rates for EVs comes with its own set of challenges and complexity. At Kliks given our ethos on sustainability and a greener planet we have put significant effort into putting together baseline rates for EV electric charging costs based on location and utility company used.

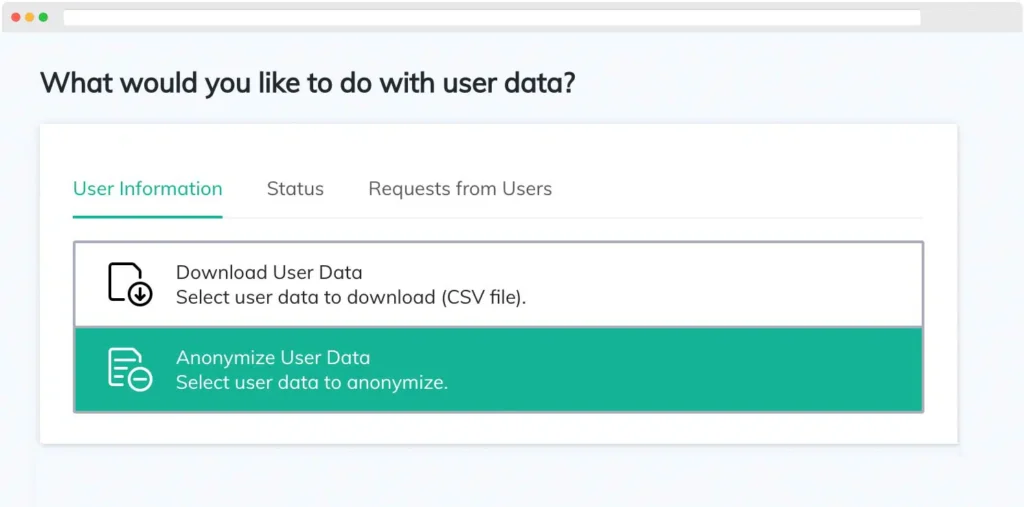

Platform-wide GDPR support

Kliks protects users’ personal data according to the requirements of the GDPR as it is transferred to and processed in the United States and Canada. We provide a full range of support features as mandated by the GDPR regulations:

Anonymize Data

Company admins can request that a user's data is anonymized / de-identified.

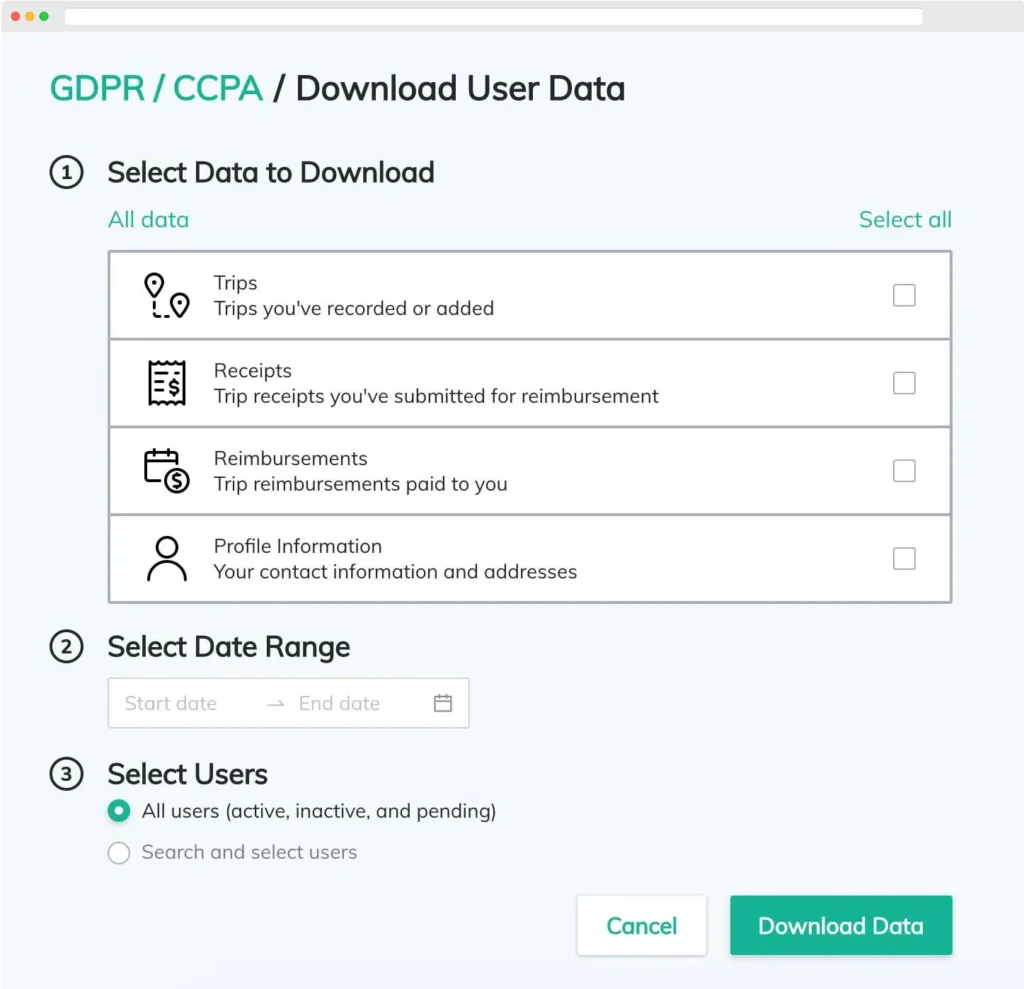

Data Portability

Admins may export some data directly from their dashboards. Admins can also request additional user data from Kliks, which will be made in a common format.

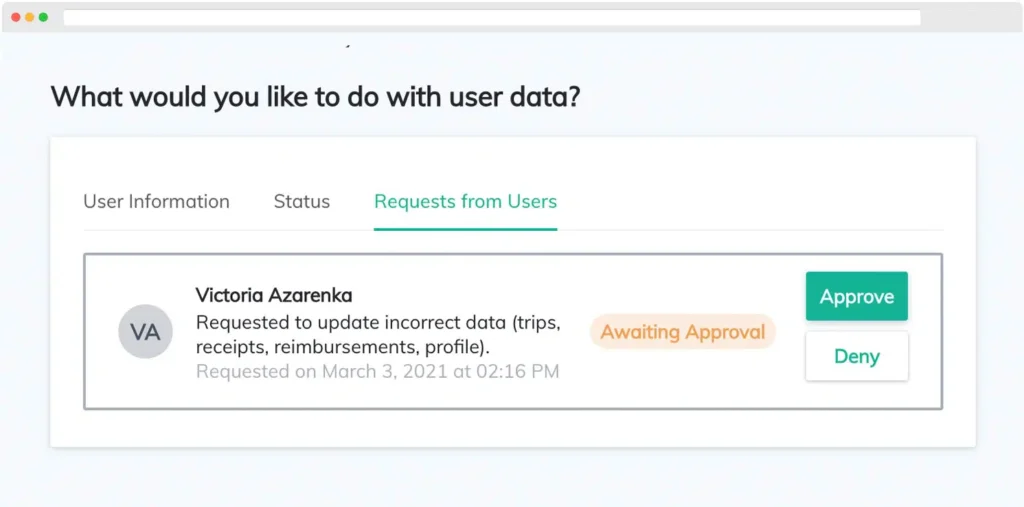

Data Rectification

Kliks offers users and admins the ability to update personal information that is incorrect.